Start Your Business

With Confidence

Your big idea deserves a bold execution.

Say goodbye to stress and hello to your

new business.

Bootstrapped, Founder Led, Independently Owned Since 2004 With Over 1,000,000 Entrepreneurs Served!

Incorpora's

Startup Central

The media center. Guts, grit, and a game plan

for launching your business.

Formation Packages

Customize it. Make it yours.

Business Formation

Packages

Business Formation Packages

Company Formation

Certificate Of Formation

Registered Agent For 1 Year

USA Virtual Address For 1 Year

EIN (Employer Identification Number)

Stripe Business Account Setup

Operating Agreement

Basic Tax Consultations

Mercury/Relay/Airwallex /Wise Bank Account Setup

Boi Report Filling

International Business Guidelines

Paypal Business Account Setup

Inter ITIN Number

Basic

One Time Fee

$149

+ State Fee

- Company Name Availability Check

- Company Formation

- Certificate Of Formation

- Registered Agent For 1 Year

- USA Virtual Address For 1 Year

- EIN (Employer Identification Number)

- Stripe Business Account Setup

- Operating Agreement

- Basic Tax Consultations

- Boi Report Filling

MOST POPULAR

Standard

One Time Fee

$299

$̶2̶9̶9̶

+ State Fee

- Company Name Availability Check

- Company Formation

- Certificate Of Formation

- Registered Agent For 1 Year

- USA Virtual Address For 1 Year

- EIN (Employer Identification Number)

- Stripe Business Account Setup

- Operating Agreement

- Basic Tax Consultations

- Boi Report Filling

- International Business Guidelines

- Inter ITIN Number

- Mercury/Relay/Airwallex /Wise Bank Account Setup

Premium

One Time Fee

$599

$̶5̶9̶9̶

+ State Fee

- Company Name Availability Check

- Company Formation

- Certificate Of Formation

- Registered Agent For 1 Year

- USA Virtual Address For 1 Year

- EIN (Employer Identification Number)

- Stripe Business Account Setup

- Operating Agreement

- Basic Tax Consultations

- Boi Report Filling

- International Business Guidelines

- Inter ITIN Number

- Paypal Business Account Setup

- Mercury/Relay/Airwallex /Wise Bank Account Setup

Launch Your LLC in Minutes

Say goodbye to stress and hello to your new business.

Quick quiz to determine the best structure for your business

Quick quiz to determine the best structure for your business

Everything You Need

All in one place.

Documents Need For US LLC Formation

Documents Need For UK LTD Formation

Resources, Guides, and Articles

All in one place.

Find the Entity That's Right For You

Incorpora will guide you through the process. Use our resources

to select a business formation type.

Did you know LLCs are the most popular choice for startups?

Limited Liability

Companies (LLCs)

Flexibility & Operational Ease

Unmatched in flexibility and simplicity, ideal for entrepreneurs who prefer an easy setup and minimal bureaucracy.

Ownership & Management

No limit on owners; flexible management options allow for tailored operational control, suitable for diverse business models.

Taxation Advantages

Benefits from pass-through taxation, with an option for corporate taxation, offering tax flexibility to members.

Liability Protection

Provides strong protection of personal assets from business liabilities, crucial for businesses with substantial risk.

Compliance Requirements

Moderate, with the potential need for reformation upon membership changes, depending on state laws.

Financing Options

Suited for funding through member contributions and bank loans, though may face challenges in attracting external investors.

Great Choice For

Entrepreneurs and startups seeking operational flexibility, personal liability protection, and tax options, especially in high-risk sectors.

S-Corporations (S-Corps)

Flexibility & Operational Ease

Unmatched in flexibility and simplicity, ideal for entrepreneurs who prefer an easy setup and minimal bureaucracy.

Ownership & Management

No limit on owners; flexible management options allow for tailored operational control, suitable for diverse business models.

Taxation Advantages

Benefits from pass-through taxation, with an option for corporate taxation, offering tax flexibility to members.

Liability Protection

Provides strong protection of personal assets from business liabilities, crucial for businesses with substantial risk.

Compliance Requirements

Moderate, with the potential need for reformation upon membership changes, depending on state laws.

Financing Options

Suited for funding through member contributions and bank loans, though may face challenges in attracting external investors.

Great Choice For

Entrepreneurs and startups seeking operational flexibility, personal liability protection, and tax options, especially in high-risk sectors.

C-Corporations (C-Corps)

Flexibility & Operational Ease

Unmatched in flexibility and simplicity, ideal for entrepreneurs who prefer an easy setup and minimal bureaucracy.

Ownership & Management

No limit on owners; flexible management options allow for tailored operational control, suitable for diverse business models.

Taxation Advantages

Benefits from pass-through taxation, with an option for corporate taxation, offering tax flexibility to members.

Liability Protection

Provides strong protection of personal assets from business liabilities, crucial for businesses with substantial risk.

Compliance Requirements

Moderate, with the potential need for reformation upon membership changes, depending on state laws.

Financing Options

Suited for funding through member contributions and bank loans, though may face challenges in attracting external investors.

Great Choice For

Entrepreneurs and startups seeking operational flexibility, personal liability protection, and tax options, especially in high-risk sectors.

Non-Profit Organizations

Flexibility & Operational Ease

Unmatched in flexibility and simplicity, ideal for entrepreneurs who prefer an easy setup and minimal bureaucracy.

Ownership & Management

No limit on owners; flexible management options allow for tailored operational control, suitable for diverse business models.

Taxation Advantages

Benefits from pass-through taxation, with an option for corporate taxation, offering tax flexibility to members.

Liability Protection

Provides strong protection of personal assets from business liabilities, crucial for businesses with substantial risk.

Compliance Requirements

Moderate, with the potential need for reformation upon membership changes, depending on state laws.

Financing Options

Suited for funding through member contributions and bank loans, though may face challenges in attracting external investors.

Great Choice For

Entrepreneurs and startups seeking operational flexibility, personal liability protection, and tax options, especially in high-risk sectors.

Business without barriers

Business without barriers

To the side-hustlers, founders, learners, innovators, action-takers, move-makers, first-timers, and serial starters - Welcome. This community is for you.

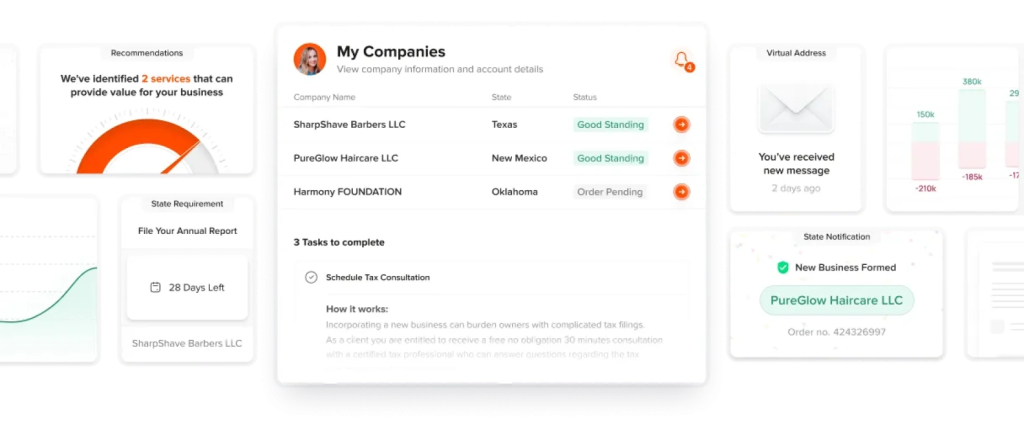

Your Personalized Dashboard

Everything you need: Business essentials and reminders in one place.